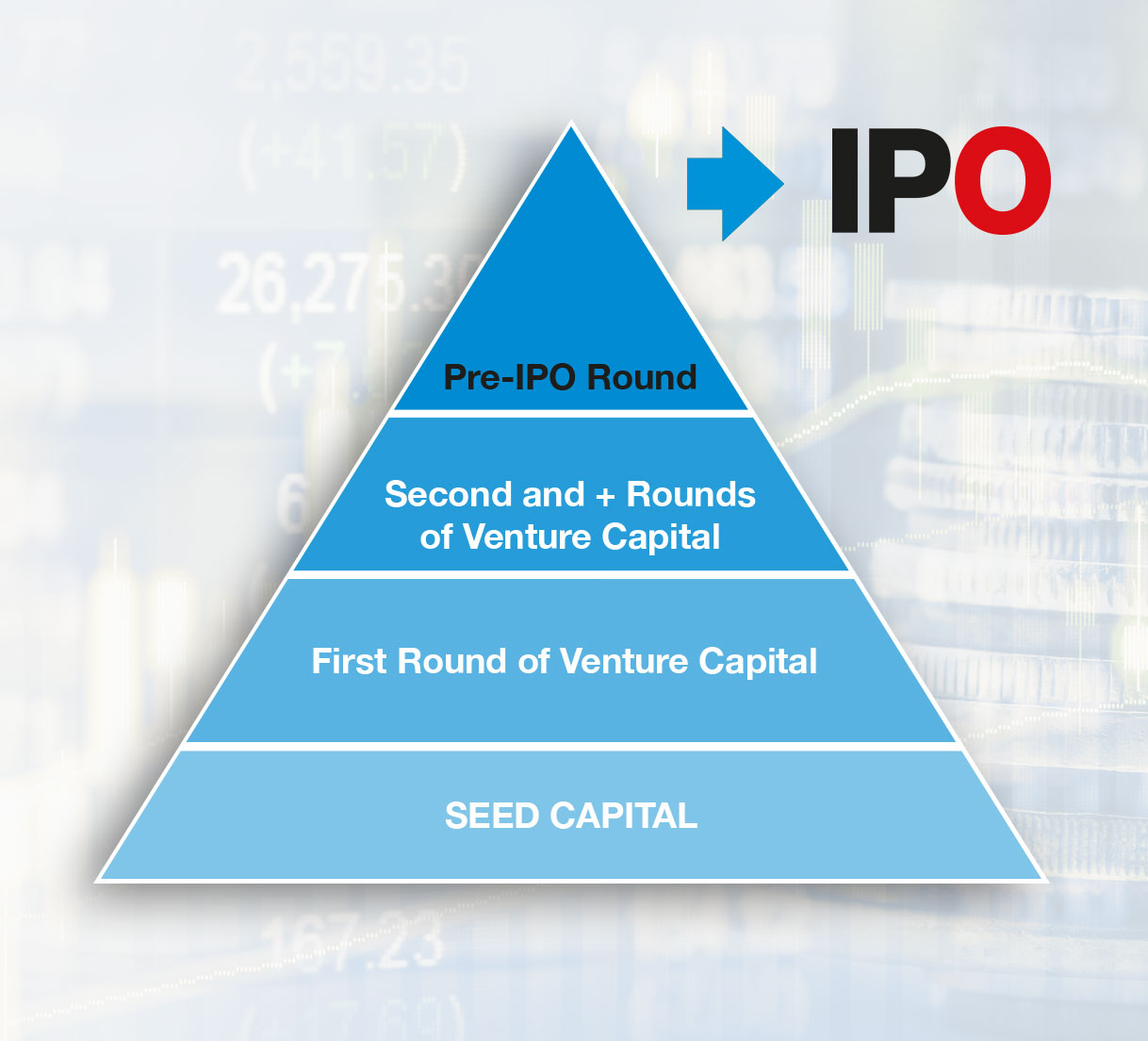

Pre-IPO Round

IPOSCOPE

Pre-IPO Round

-

Co-ordination of the preparatory measures of the pre-IPO round of private equity

-

Detailed input on the valuation of the company under the assumption of a near term public listing

-

Advice on the selection of the appropriate investors, including a possible lead investor, based on valuation negotiations, the name recognition, the sector credibility and the possible logic for a pole position in the subsequent Initial Public Offering (IPO)

-

Support on joint or one-on-one meetings with potential investors, including the banking community

-

Steering of the negotiations regarding the constitution of the pre-IPO group of investors

-

Support on the coaching of management and the preparation for the Due Diligence process

-

Advice on the selection of the auditors and legal counsel for the placement

-

Co-ordination of the drafting and supervision of the marketing conformity of a Private Placement Memorandum (PPM)

-

Structuring of the process, including the PPM, to facilitate the company’s IPO